The ‘New’ Mexico: The Status of Mexico’s Energy Reform and How U.S. Companies Can Benefit

Energy reform in Mexico means a new era of partnerships, foreign direct investment, and future success stories in the country, write Edward H. Warner and Daniela Suarez de los Santos of Kean Miller in a new article.

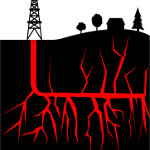

The recent announcement of a $900 million transaction to send U.S. natural gas to central Mexico represents the first large scale infrastructure investment in Mexico since its energy sector was opened to foreign investors in 2013. is only the beginning.

On its website, the firm says, “The questions to consider are: what are the opportunities, what are the challenges, and how can U.S. companies make this groundbreaking change work for them?”

Argus has posted a free on-demand webinar discussing the outlook for Mexico’s demand for energy exports from the United States.

Argus has posted a free on-demand webinar discussing the outlook for Mexico’s demand for energy exports from the United States. Deloitte will present a Dbriefs webcast on strategies and potential paths forward for oil and gas companies across the value chain, including upstream, oilfield services, midstream, and downstream, in a challenging investment environment.

Deloitte will present a Dbriefs webcast on strategies and potential paths forward for oil and gas companies across the value chain, including upstream, oilfield services, midstream, and downstream, in a challenging investment environment. Borrowing base reductions seem a certainty for many oil and gas producers, says a new white paper published by Haynes and Boone.

Borrowing base reductions seem a certainty for many oil and gas producers, says a new white paper published by Haynes and Boone. Platts presents a free on-demand webinar discusses the role the Gulf Coast of the United States plays in supplying refine petroleum products to the world.

Platts presents a free on-demand webinar discusses the role the Gulf Coast of the United States plays in supplying refine petroleum products to the world.

The U.S. Department of Labor recently announced the results of a 2014 enforcement initiative that focused on the oil and gas industry in New Mexico and west Texas, an effort that recovered more than $1.3 million owed to some 1,300 employees as a result of this investigation.

The U.S. Department of Labor recently announced the results of a 2014 enforcement initiative that focused on the oil and gas industry in New Mexico and west Texas, an effort that recovered more than $1.3 million owed to some 1,300 employees as a result of this investigation. An increase in U.S. domestic crude oil and natural gas production coupled with transportation infrastructure limitations have resulted in supply and demand imbalances across the country and increased market price volatilities, reports a white paper posted by Oil & Gas Financial Journal and sponsored by Opportune.

An increase in U.S. domestic crude oil and natural gas production coupled with transportation infrastructure limitations have resulted in supply and demand imbalances across the country and increased market price volatilities, reports a white paper posted by Oil & Gas Financial Journal and sponsored by Opportune. The University of California at Davis Policy Institute for Energy, Environment, and the Economy has posted a complimentary webinar on role of natural gas on trucking in the United States, presenting new research by the UC Davis Institute of Transportation Studies.

The University of California at Davis Policy Institute for Energy, Environment, and the Economy has posted a complimentary webinar on role of natural gas on trucking in the United States, presenting new research by the UC Davis Institute of Transportation Studies.