By Mark Perkins

Perkins & Associates, LLC

In any instance involving the tragic loss of life or serious injury in commercial truck collisions, extensive discovery is required and one of the critical areas focuses on proof of hours of service violations. It then focuses on how the proof of chronic violation of hour of service safety regulations can provide the basis for proof not only of negligence, but punitive damages against the company and driver.

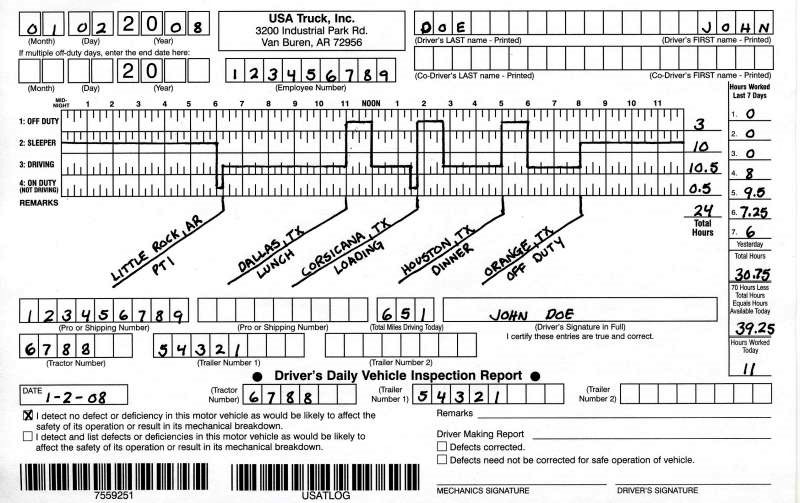

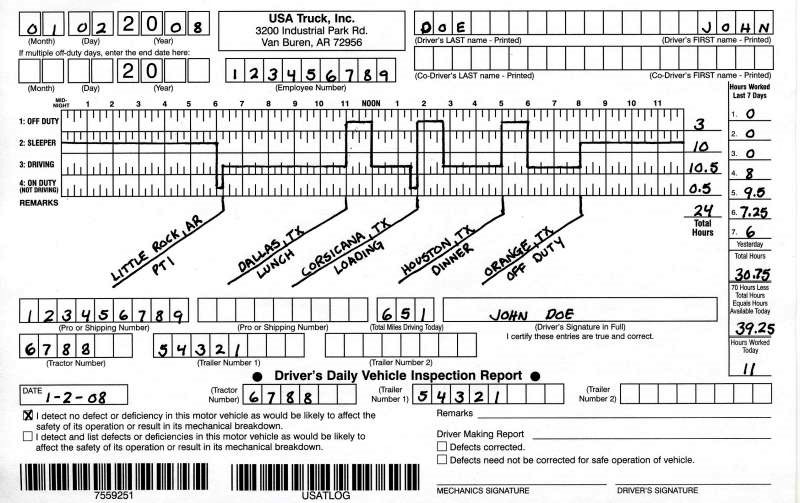

Where the driver’s log and grid show 3.5 hours driving time, but shows a route of 300 miles being covered, one can conclude:

- The driver has lied about the time he spent driving, or

- The driver was flagrantly speeding throughout his route (a truck obeying speed limits on highways will average 50 miles in an hour).

If a driver shows a 24-hour period of duty and begins with “driving” as the first entry, the driver has probably cheated on listing his duty time. It usually takes from 30-60 minutes for a driver to report to duty to the yard, get all of his paperwork, inspect his load, and perform the required inspections on his rig.

Where a driver logs 11 hours of driving time for the preceding 24-hour period and fails to get or log 10 solid hours of “off duty” time before resuming duty and driving, all of his driving for the following day is illegal and in violation of the safety regulations set forth in 49 C.F.R. 395.3.

Time and location of sequential fuel receipts can be important in showing the impossibility of compliance with the hours of service regulations in 49 C.F.R. 395.3.

Plaintiff’s attorneys investigating hours of service are suspicious that hours of service have been violated and records of driver’s duty status have been falsified until proven otherwise. In evaluating and defending claims for trucking companies, the defense attorney needs to THINK like his opponent.

Review and careful analysis of the following documents helps cross reference criteria to check for validity or invalidity of driver’s duty hours:

- Driver’s log as required by 49 C.F.R. 395.8 for the day of the collision.

- Driver’s logs for defendant driver for the 6 months preceding the collision in question.

- Graph Grid required by 395.8 (g) for that day and for the 6 months preceding the collision.

- Records of automatic on-board recording devices required by 49 C.F.R. 395.15 for the day of the collision and the 6 months preceding.

- All payroll, or payment logs, or records for that driver for the time period, including the collision and 6 months prior thereto.

- All W-2’s for the driver in question for the withholding period, which includes the collision in question, and all reporting periods for 6 months prior thereto.

- All fuel receipts incurred from the time the truck left the carrier’s premises until the time of the collision.

- All Bills of Ladings and manifests pertaining to property transported and/or delivered from the time the truck left the carrier’s premises until the time of the collision.

The reason plaintiff’s attorneys ask for six months of logs is because of the belief that driver and company’s violation of hours of service regulations fall into a pattern. Examination of the logs and data for the prior 6 month period may reveal those patterns. Where such patterns exist, an argument will be made of flagrant disregard of safety regulations, which “needlessly endanger” the general public (for those familiar with the “reptile theory” the phrase “needlessly endanger” is common).

The following post was written by a plaintiff’s attorney and is common refrain among plaintiff’s counsel:

49 C.F.R. Part 395 protects the public from the hazard of fatigued drivers operating huge trucks in their midst. The hours of service regulations have been written from the blood of innocent citizens massacred by huge trucks at the hands of drivers impaired from fatigue. Where a driver and carrier intentionally violate the safety regulations designed to guard against fatigue, they have shown a conscious disregard for the safety of the public using our highways. Where such a fatigued driver has caused injury or death, the driver and carrier have acted with conscious and reckless disregard for the life and safety of the public on the highways. This conduct justifies a punitive damage award against them, in addition to compensatory damages.

A bill approved by Congress on Dec. 3, 2015 calls for a Federal Motor Carrier Safety Administration study on truck drivers’ long commutes and the safety hazards they present.

The $305-billion Fixing America’s Surface Transportation Act requires that the U.S. Department of Transportation agency to track workforce commutes of two hours or more and provide an analysis of them in 18 months.

The section of legislation inserted into the potential new law is a direct result of the crash that almost killed former Saturday Night Live cast member Tracy Morgan. It states:

“Section 5515 requires the Administrator of the FMCSA to conduct a study on the safety effects of a motor carrier operator commuting more than 150 minutes. On June 17, 2014, a tractor-trailer struck a van near Cranbury, New Jersey, killing one person and injuring several others. According to the National Transportation Safety Board, the truck driver had been awake more than 24 hours at the time of the crash. In addition, the Georgia-based driver had driven 12 hours overnight to his job in Delaware before starting his shift. The study shall address the prevalence of long commutes in the industry and the impact on safety.”

If you’re a trucking defense attorney and you don’t evaluate the case like a plaintiff’s attorney would, you are not providing diligent representation.

If you’re a trucking company or insurance company and you get offended by your legal representative diligently looking for problems and thinking like his opponent, you need to get over it. Your defense attorney is trying to help your company survive and thrive in this litigious society. Be grateful that your legal counsel is a looking for problems. It’s better to know in advance than to be surprised.

The U.S. Department of Justice has filed lawsuits to block the proposed mergers of four of the nation’s five biggest health insurers, reports The New York Times.

The U.S. Department of Justice has filed lawsuits to block the proposed mergers of four of the nation’s five biggest health insurers, reports The New York Times.

Now more than ever, corporate directors are finding themselves named in lawsuits, says Katherine Henderson, veteran insurance board advisor and partner with

Now more than ever, corporate directors are finding themselves named in lawsuits, says Katherine Henderson, veteran insurance board advisor and partner with  A recent decision from the Northern District of Illinois illustrates the pitfalls that could arise from current insurance industry practices involving the issuance of privacy statements and insurance policies if done without the appropriate precautions, according to a report by Carol J. Gerner and Cinthia Granados Motley for

A recent decision from the Northern District of Illinois illustrates the pitfalls that could arise from current insurance industry practices involving the issuance of privacy statements and insurance policies if done without the appropriate precautions, according to a report by Carol J. Gerner and Cinthia Granados Motley for

The 6th U.S. Circuit Court of Appeals has issued a sweeping decision that confirms that “ordinary principles of contract law” rarely will require a company to freeze outdated lifetime health coverage benefits in place, write

The 6th U.S. Circuit Court of Appeals has issued a sweeping decision that confirms that “ordinary principles of contract law” rarely will require a company to freeze outdated lifetime health coverage benefits in place, write